Business Insurance in and around Aurora

Looking for small business insurance coverage?

Cover all the bases for your small business

Business Insurance At A Great Value!

Though you work so hard to ensure otherwise, it is good to recognize that some things are simply out of your control. Problems happen, like a customer hurts themselves on your property.

Looking for small business insurance coverage?

Cover all the bases for your small business

Surprisingly Great Insurance

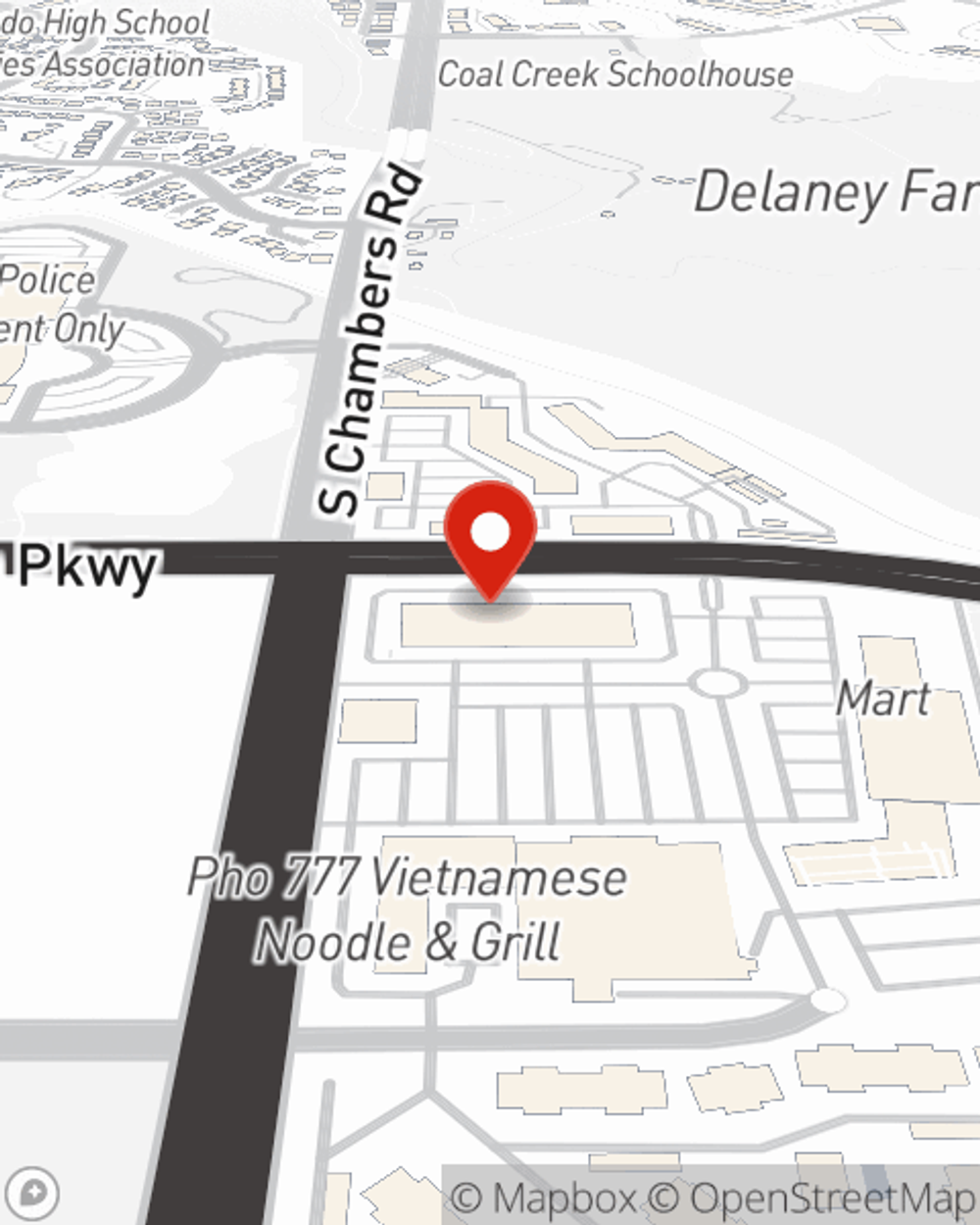

Protecting your business from these possible catastrophes is as easy as choosing State Farm. With this small business insurance, agent Scott Underwood can not only help you devise a policy that will fit your needs, but can also help you submit a claim should an issue like this arise.

So, take the responsible next step for your business and contact State Farm agent Scott Underwood to explore your small business insurance options!

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Scott Underwood

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.